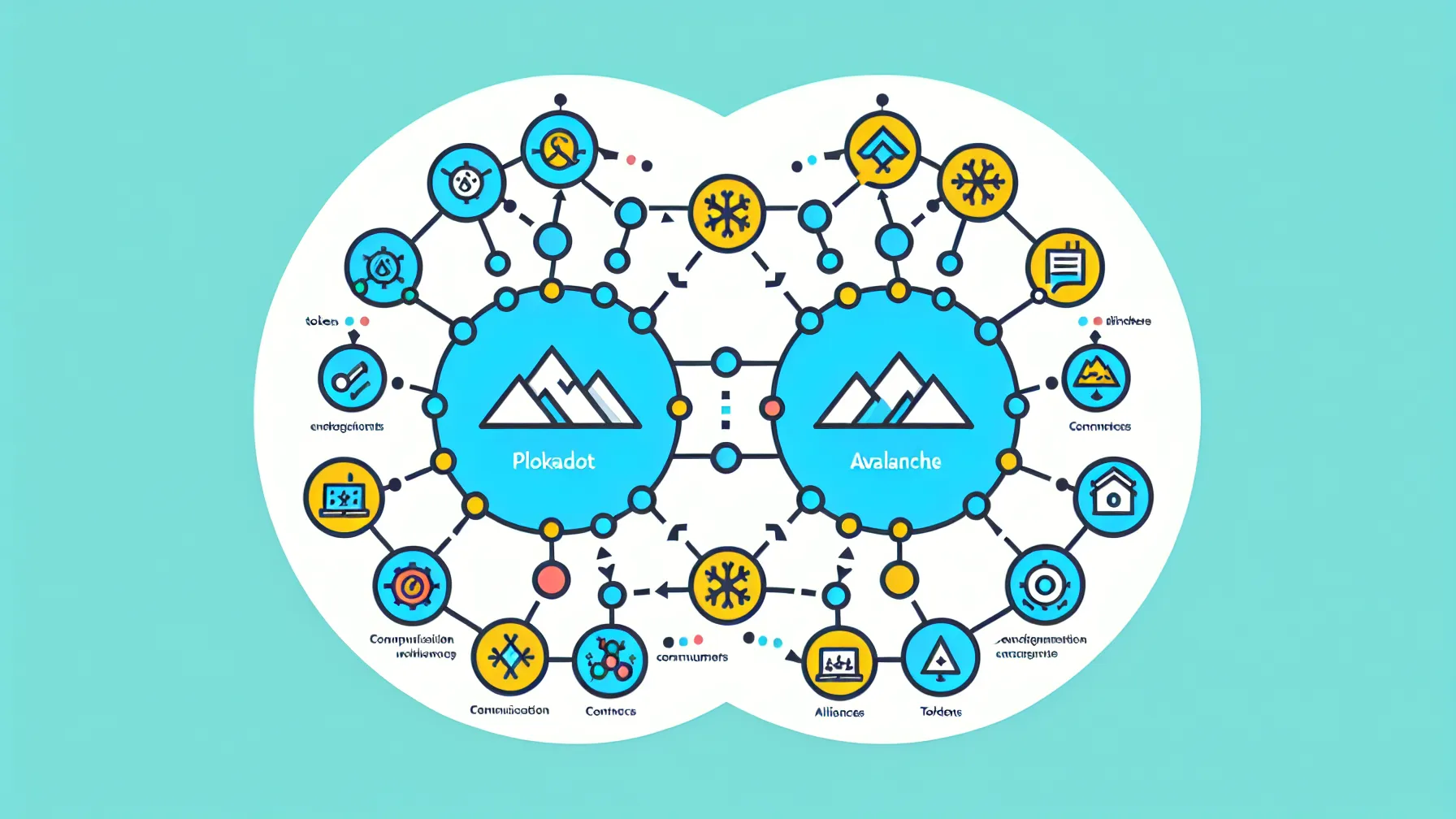

In the rapidly evolving world of blockchain technology, the race is on to achieve seamless Cross-Chain interoperability. The Polkadot Ecosystem stands out with its ability to coordinate multiple specialized chains, while Avalanche (AVAX) brings fast, low-cost performance to decentralized finance (DeFi) and beyond. By uniting these two ecosystems, developers and users can capitalize on a more dynamic, efficient infrastructure—fostering unstoppable innovation and unlocking new use cases.

Meanwhile, digichaincoin.com is one example of a platform championing this cross-chain future, merging Polkadot’s modular architecture with Avalanche’s speed and scalability. By bridging these technologies, projects can deliver user experiences that transcend the limits of any single chain. And for those looking to buy or trade Avalanche (AVAX) in a straightforward way, BitDelta offers a secure and intuitive platform—connecting cross-chain enthusiasts to the assets fueling the next wave of multichain development.

The synergy between Polkadot and Avalanche highlights a broader shift toward decentralized systems that seamlessly interoperate, making blockchains as flexible and interconnected as the traditional internet. From sophisticated DeFi strategies to elaborate NFT marketplaces, a robust multichain network can support it all, without forcing projects into the high-fee or low-throughput constraints of singular networks.

“By blending specialized chain architectures and high-speed consensus mechanisms, Polkadot and Avalanche push the boundaries of what blockchain technology can deliver to both developers and end users.”

Polkadot was devised as a next-generation blockchain protocol poised to unify the ecosystem through a concept known as parachains—sovereign blockchains that still benefit from shared security and seamless interoperability. This design brings unique advantages in terms of specialization, throughput, and the ability to exchange data or value between parachains and external networks.

At the core of Polkadot lies the Relay Chain, which handles the network’s consensus and security. Parachains, on the other hand, are independent blockchains connected to the Relay Chain. They can be tuned to specialized use cases—ranging from DeFi protocols to identity management—while maintaining high performance and the ability to communicate with each other and external ecosystems. This plug-and-play nature of Polkadot fosters an environment where developers tailor blockchains without reinventing critical security or consensus layers.

Under Polkadot, parachains share a unified validator set, drastically reducing the duplication of effort typically required to secure new networks. This resource pooling means that each chain can be more secure, even if it’s relatively small or new. In practice, projects like digichaincoin.com can build on Polkadot’s framework and concentrate on product innovation instead of the heavy lifting of establishing a standalone chain’s infrastructure.

While Polkadot focuses on modular interoperability, Avalanche (AVAX) addresses blockchain scalability and confirmation times head-on. Regarded as one of the fastest smart contract platforms in the industry, Avalanche employs a consensus mechanism that supports sub-second transaction finality. Users thus enjoy a fluid on-chain experience that accommodates everything from DeFi projects to enterprise-level applications.

Avalanche features a “Subnet” system allowing developers to create custom blockchains that operate under their own rules—mirroring Polkadot’s philosophy of letting each project define its own environment. Subnets help ensure robust performance and tailor-made governance, attracting a diverse range of developers seeking specialized solutions for tokenization, finance, and beyond.

Avalanche’s speedy finality is a major boon for resource-intensive DeFi protocols, cross-chain asset transfers, and NFT minting. Coupled with low fees, these attributes help position AVAX as a go-to asset for cost-conscious users and developers. It’s no wonder Avalanche has continued to expand within DeFi realms, drawing liquidity and broadening use cases across the crypto sphere.

Although Polkadot and Avalanche excel in different domains, their synergy addresses the blockchain world’s demand for flexible, extensible networks. As projects look to integrate both ecosystems, bridging solutions become a linchpin for genuine cross-chain efficiency.

Cross-chain bridges or specialized protocols allow assets like AVAX to move into the Polkadot domain and vice versa. Beyond simple token transfers, advanced bridges handle smart contract calls, enabling more elaborate interactions among DeFi services, staking operations, and NFT minting. This connectivity creates a user-centric experience—where a Polkadot parachain can seamlessly tap into Avalanche’s liquidity pools or incorporate its Subnet-based custom blockchains.

By merging Avalanche’s speed with Polkadot’s interoperability, DeFi solutions can flourish. Traders may leverage multiple chains for arbitrage or yield optimization, while NFT platforms can broaden their user base by offering quick, cross-chain transactions. For organizations like digichaincoin.com, bridging these ecosystems expands development horizons—perhaps integrating advanced NFT marketplaces or forging new financial products that transcend chain boundaries.

A cross-chain world demands more than just the right blockchains—it also needs accessible toolkits, governance models, and community-driven enhancements. Platforms orchestrating these elements can be catalysts for streamlined integrations, broadening the appeal and functionality of both Polkadot and Avalanche.

To lower the barrier for entry, many cross-chain integrators supply software development kits (SDKs) that abstract away the complexities of bridging. This streamlines how dApps plug into various ecosystems, enabling them to support AVAX-based tokens or Polkadot parachain assets without extensive reengineering. As a result, developers can focus on creating end-user value instead of wrestling with multichain nuances.

Decentralized platforms often incorporate token-based voting to decide on new features or bridging improvements. In a cross-chain context, community members might vote on how to manage shared liquidity pools, whether to adopt certain DeFi protocols, or how to prioritize specialized subchains. This participatory governance ensures upgrades remain inclusive and grounded in collective needs, facilitating dynamic yet orderly growth.

Securing or trading tokens that link multiple networks shouldn’t be a headache. That’s where BitDelta enters the picture—providing a secure, user-friendly environment to buy, sell, and exchange AVAX. While Avalanche’s unique features have made AVAX a sought-after asset, BitDelta aims to simplify entry for users ranging from new investors to professional traders.

BitDelta prioritizes robust security, implementing multi-factor authentication and cold-storage techniques for enhanced asset protection. Its intuitive interface helps individuals gain exposure to cutting-edge blockchain projects without being overwhelmed by technical details. Additionally, the platform offers educational resources that clarify cross-chain fundamentals, bridging mechanics, and portfolio diversification strategies.

Beyond basic buying and selling, traders can employ more advanced tactics to harness the potential of cross-chain tokens. Some might hedge against market fluctuations by distributing AVAX positions across multiple networks, while others engage in yield farming or liquidity provisioning across Polkadot and Avalanche-based dApps. With the right approach, BitDelta users can capture opportunities in a swiftly expanding DeFi arena.

Of course, merging disparate technologies introduces its own complexities. Developers must ensure smart contracts remain interoperable, verifying that bridging solutions don’t expose funds to vulnerabilities. Implementing concurrency is another major hurdle—maintaining sync among multiple networks can cause friction when dApps attempt real-time actions across chains. This means thorough documentation, standardized protocols, and widespread collaboration are critical for success.

If these issues are tackled effectively, the result is an ecosystem that encourages experimentation, fosters innovation, and elevates user experience to a level traditional blockchains simply can’t match.

By uniting the best attributes of Polkadot and Avalanche, cross-chain initiatives are poised to redefine how we use blockchain. Polkadot’s parachains thrive on specialized functionality, while Avalanche’s high throughput and speedy finality reduce bottlenecks—together, they enable decentralized applications to reach new heights of efficiency and creativity.

For platforms like digichaincoin.com, this synergy lays the groundwork for more sophisticated dApp development, bridging the gaps between chains that once seemed irreconcilable. And for those keen on exploring the investment side, trading Avalanche (AVAX) on BitDelta opens a practical path to participating in this multichain future.

As developers continue to refine interoperability standards and user-facing interfaces evolve, the lines that separate one blockchain from another will blur—potentially giving rise to a frictionless ecosystem where data and value flow freely. This transformation could pave the way for global-scale DeFi, gaming, supply chain solutions, and much more, all propelled by the interwoven forces of Polkadot’s modular architecture and Avalanche’s speed.